Seize the Opportunity for Breakthrough Growth with Market Making Innovation

In the fast-paced cryptocurrency market, efficient liquidity management and risk control are crucial. Frontier Lab offers comprehensive market-making solutions for exchanges and token issuers, helping you stand out in this dynamic market full of opportunities and challenges.

Enhance market liquidity

Build liquid and efficient markets through market making.

Reducing Trading Costs

Automated Process

Pricing and Arbitrage

Before

After

Market Making tightens bid-ask spreads around the spot price to facilitate trading at a fair price, hence reducing the costs to traders

Our algorithms continually refresh orders near the mid price, encouraging larger trades. Liquidity is auto-adjusted for optimal market making for clients.

Prices are aligned across exchanges, seizing opportunities for arbitrage between centralized and decentralized platforms.

Innovative Blockchain Liquidity

Management and MAAS

Frontier Lab's MAAS system covers the entire process, from market making to

risk control and data analysis. Whether you're an experienced market participant

achieve your business goals

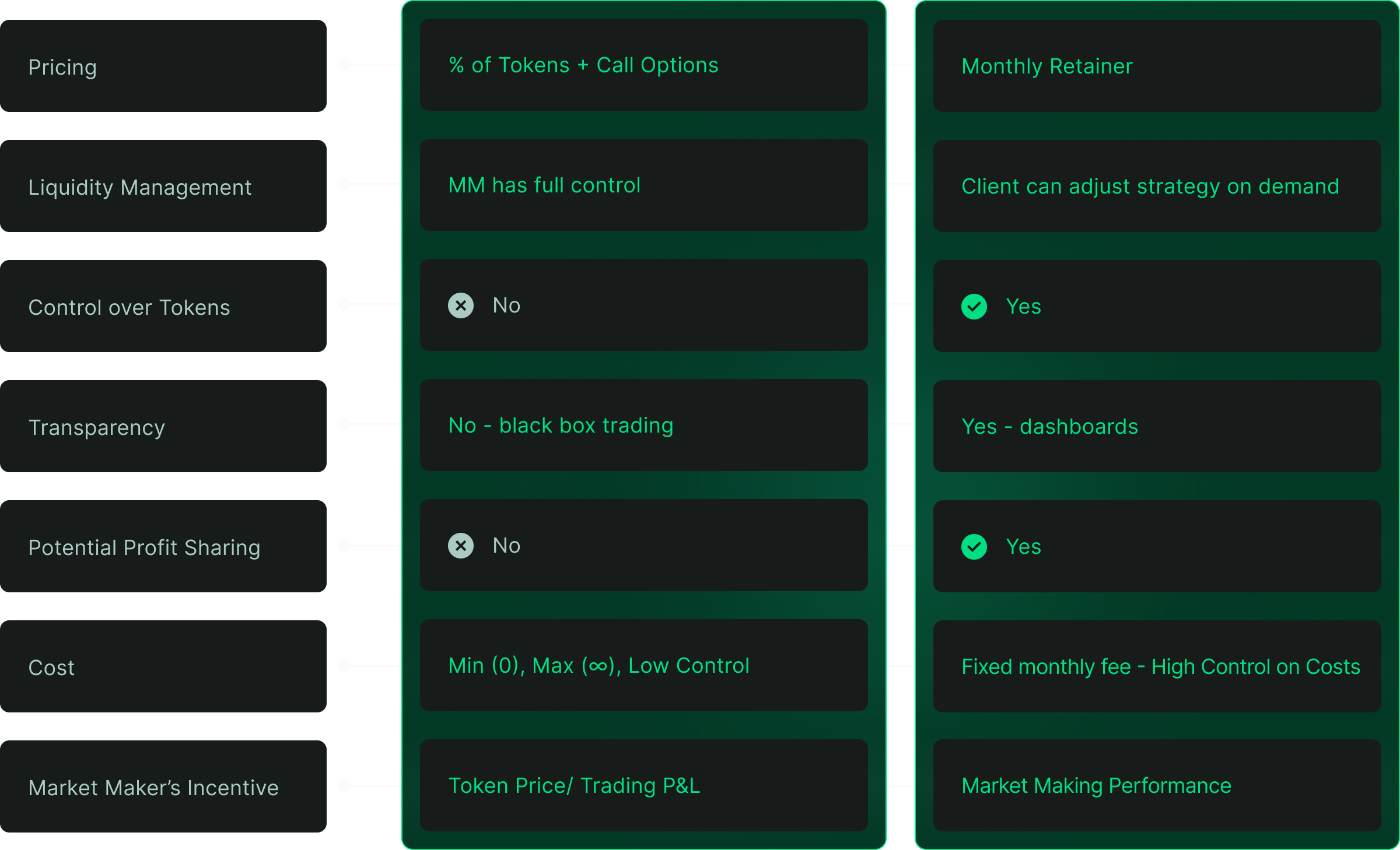

Feature

Propietary Market-Making

Frontier's Market Making as a Service

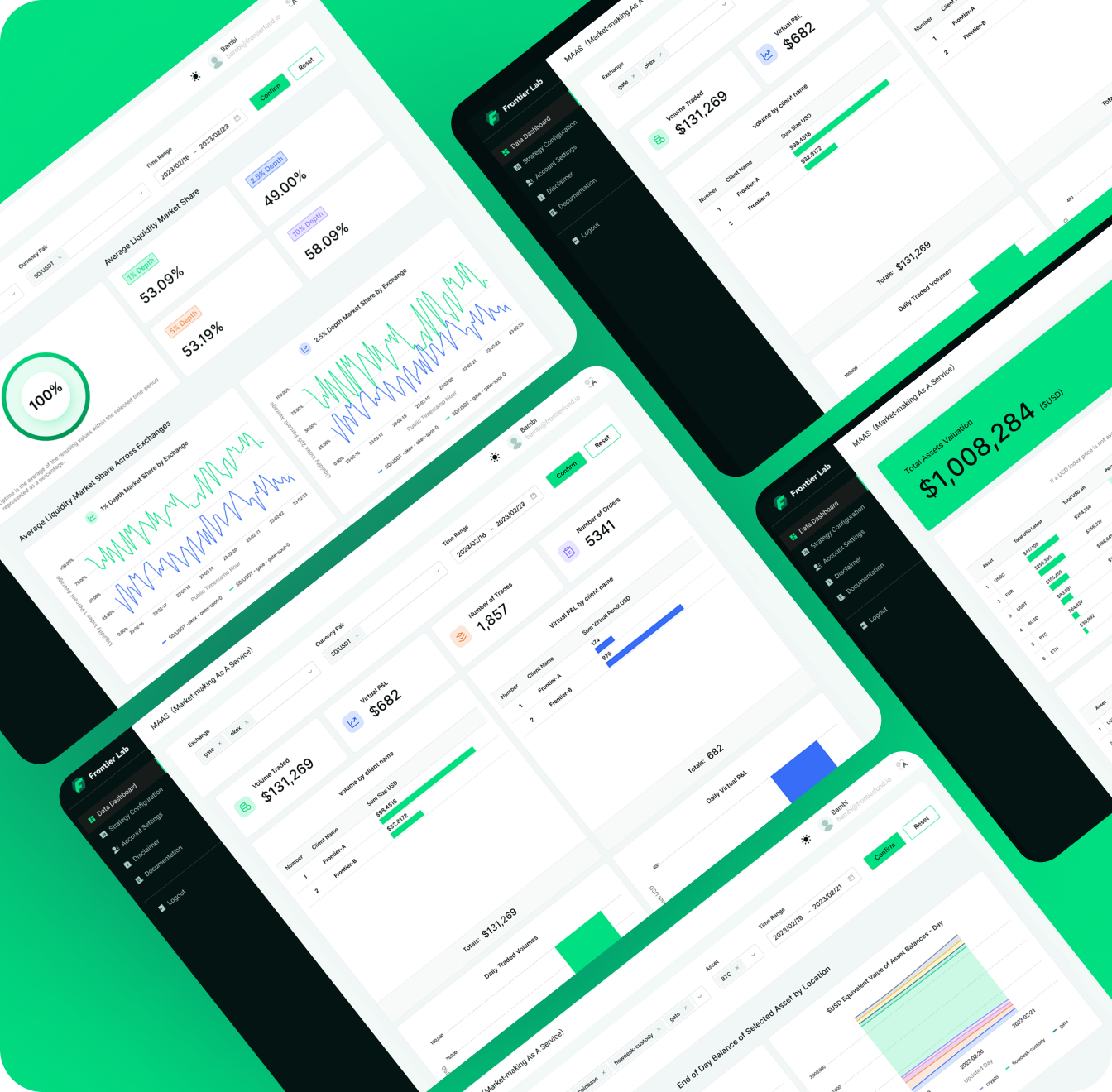

Visual Dashboards

Transparent Market Making at Your Fingertips

With Frontier Lab's customized dashboard, clients can monitor assets and

trades in real-time, ensuring complete transparency in the market-making

process. Our powerful strategy tools help clients make precise decisions

and maximize returns.

Liquidity

- ·Market share

- ·Liquidity allocation

- ·Depth distribution

Trades

- ·Ecution distribution

- ·Real time volumes

- ·Volumes per exchange

Balances

- ·Hourly balance by location

- ·Day balance by Location

- ·All times shown are in UTC

Market Making

- ·Virtual P&L

- ·Number of trades/orders

- ·Volumes by exchange

Assets

- ·Total Assets Valuation

- ·Historical balances

- ·Breakdown by Asset, Locationt

Partners in the Journey

Frontier Lab is providing liquidity on over 50 exchanges and trading platforms